Tata Steel Share Price Target (2025-2050): Forecast & Investment Guide

Confused about which stock to invest in for the long term? Here’s a deep dive into Tata Steel—one of India’s most prominent and globally diversified steel giants—along with monthly and annual share price predictions, expert insights, and actionable tips. Perfect for beginners and investors seeking high potential!

- About Tata Steel Ltd

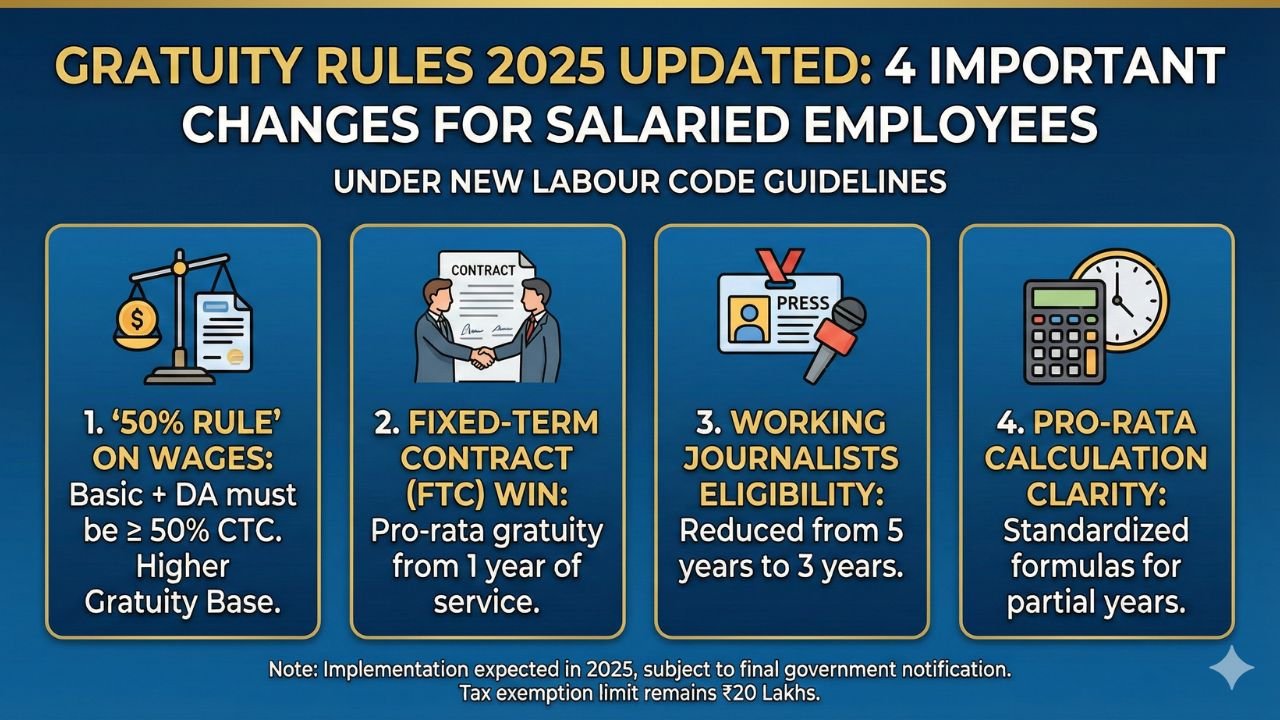

- Infographic: Predicted Share Price Growth

- Tata Steel Share Price Target 2025 (Monthly)

- Tata Steel Share Price Target 2026 (Monthly)

- Long Term Share Price Targets (2027, 2030, 2040, 2050)

- Is Tata Steel Good to Buy? (Bull & Bear Case)

- Tata Steel: Latest Key Financials (2024)

- FAQs about Tata Steel Investment

- Join Our Telegram Channel

About Tata Steel Ltd

Tata Steel Ltd is one of the world’s largest and most geographically diversified steel-making companies, with major operations in India, the Netherlands, and the UK. The company boasts an annual crude steel capacity of 34 million tons (FY22) and a workforce of around 80,500 employees. Its legacy, innovation, and global presence make Tata Steel a reliable blue-chip stock in India’s stock market landscape.

- Founded: 1907

- Key Markets: India, Europe (Netherlands, UK), Southeast Asia

- Industry Rank: 2nd most diversified steel producer globally

- Brand Value: Among top 10 most valuable Indian brands

Recent years have seen Tata Steel focusing on sustainability, green steel initiatives, and strategic expansion—catering to ever-growing steel demand worldwide.

Infographic: Tata Steel’s Share Price Forecast (2025-2050)

Tata Steel Share Price Target 2025 (Monthly)

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 122 | 140 |

| February | 127 | 141 |

| March | 130 | 170 |

| April | 119 | 173 |

| May | 110 | 178 |

| June | 105 | 180 |

| July | 156 | 168 |

| August | 138 | 192 |

| September | 144 | 199 |

| October | 155 | 203 |

| November | 160 | 211 |

| December | 170 | 220 |

According to various analyst estimates, Tata Steel’s share could trade between ₹105 and ₹220 in 2025, based on current market trends and industry outlook.

Tata Steel Share Price Target 2026 (Monthly)

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 170 | 247 |

| February | 185 | 258 |

| March | 198 | 267 |

| April | 207 | 270 |

| May | 210 | 275 |

| June | 224 | 285 |

| July | 230 | 291 |

| August | 237 | 297 |

| September | 240 | 300 |

| October | 247 | 308 |

| November | 253 | 310 |

| December | 260 | 323 |

For 2026, the predicted price range is ₹170 to ₹323, with steady momentum expected as Tata Steel expands and upgrades its production facilities.

Long-Term Tata Steel Share Price Targets

2027 Forecast

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2027 | 260 | 430 |

2030 Forecast

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2030 | 520 | 770 |

2040 Forecast

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2040 | 900 | 1,200 |

2050 Forecast

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2050 | 1,700 | 1,900 |

Note: These predictions reflect a mix of expert analysis, historical trends, and expected growth in global steel demand. Long-term forecasts carry uncertainty and should be used as an informative guide, not investment advice.

Is Tata Steel Ltd. Stock Worth Buying? (Bull vs. Bear)

Bull Case (Why Investors Remain Optimistic)

- Global Footprint: Diverse revenue streams across continents, reducing country-specific risks.

- Growing Steel Demand: Worldwide infrastructure, EVs, and real estate activity are boosting demand for Tata Steel’s products.

- Operational Efficiency: Investments in advanced production technologies and cost control drive profitability.

- Focus on Sustainability: Green steel initiatives and responsible mining add long-term value and appeal to ESG-focused funds.

- Strong Dividend Track Record: Consistently pays dividends, historically outperforming FD yields for long-term holders.

Bear Case (Potential Risks to Consider)

- Cyclicality: The steel sector is prone to economic swings, impacting profitability and investor returns.

- Debt Levels: Significant debt could become a concern if global conditions worsen or interest rates climb.

- Regulatory & Geopolitical Risk: Stringent environmental norms and shifting global trade policies could pressure costs and growth.

- Raw Material Volatility: Fluctuating coal and iron ore prices affect margins.

Investment Verdict: Tata Steel is often considered a strong buy for patient, long-term investors comfortable with cyclical exposure and willing to ride out market volatility for steady compounding and dividends.

Tata Steel: Latest Key Financials (2024)

| Metric | Value (₹ Crore) |

|---|---|

| Total Revenue | 55,311.88 |

| Gross Profit | 32,865.37 |

| Total Operating Expense | 51,807.15 |

| Operating Income | 3,504.73 |

| Net Income After Tax | 522.14 |

| Diluted EPS | 0.42 |

| Dividend Yield | ~3.3% |

Solid operational efficiency and a robust dividend, even as the industry faces cyclical challenges.

FAQs about Tata Steel Investment

- Is Tata Steel a good fit for beginners? Tata Steel is a blue-chip, large-cap player that offers stability with moderate risk, especially suitable for SIPs or long-term holding.

- Does Tata Steel pay dividends regularly? Yes, the company has a history of consistent dividend payouts, supporting passive income strategies.

- Is Tata Steel future-ready? With its focus on sustainability and capacity expansion, Tata Steel is well placed to capitalize on India’s infrastructure growth and global trends.

- Where do I find Tata Steel’s investor information? Visit the official Tata Steel website or leading stock market portals for up-to-date reports and disclosures.

Post Comment