Delhi Thar Showroom Crash: Who Pays for Damages & How Car Insurance Claims Work in India

The Showroom Crash Incident in Delhi

In a widely circulated viral incident in September 2025, a new Mahindra Thar tumbled from the first floor of a popular Delhi showroom after its owner accidentally pressed the accelerator during the customary lemon-crushing pooja. This misstep caused the vehicle, worth nearly ₹27 lakh, to crash through glass panels and plunge onto the street, turning a celebratory moment into a costly mishap.

Such episodes raise natural questions: Who bears the cost of repairs? Is insurance active at delivery? What about damages to the showroom infrastructure?

How Insurance Covers New Car Deliveries

In India, the process for new car insurance is tightly regulated. Dealerships ensure vehicles are insured prior to handover, as mandated by law. The buyer pays the premium, and the policy is registered with the owner’s details, activating coverage before the vehicle leaves the outlet.

Most new cars are now delivered with a zero depreciation (zero-dep) insurance add-on, which maximizes claim value for any repair, large or small.

Any damage to the car—even during delivery rituals—is generally covered by the car insurance policy in force at that moment.

Zero Depreciation Insurance Explained

Zero depreciation (zero-dep) insurance is an optional add-on that removes the standard deduction for part wear-and-tear in claim settlements. Normally, insurance only reimburses the depreciated value of parts like tires, plastics, and glass. But with zero-dep, you get the full repair cost (minus nominal deductibles)—a tremendous advantage for new vehicles. The customer merely pays a small file/processing fee or standard deductible.

This coverage is the main reason the damaged Thar’s owner will face minimal financial burden, despite the accident.

Step-by-Step Car Insurance Claim Process

If your new vehicle meets with an accident right at delivery, here’s a practical, user-friendly guide to claiming insurance:

- Immediately inform the insurance company and the dealership about the accident.

- The insurer dispatches a surveyor to assess the damage on-site.

- The damaged car is shifted to an authorised service centre for repairs under tight documentation and supervision.

- Repair costs are settled directly between the insurer and the workshop (cashless claim), while the owner pays minimal charges (processing/file fee).

- The dealership staff usually guide the owner throughout the process, ensuring paperwork is quickly completed.

Who Pays for What: Car vs. Showroom Property

It’s crucial to understand that standard car insurance covers only the vehicle itself. Damage to the showroom—such as broken glass panels or damaged infrastructure—may not be covered by the car insurance policy. The showroom may seek compensation for property damages directly from the owner. Separate insurance (property or liability) would handle the showroom’s internal losses.

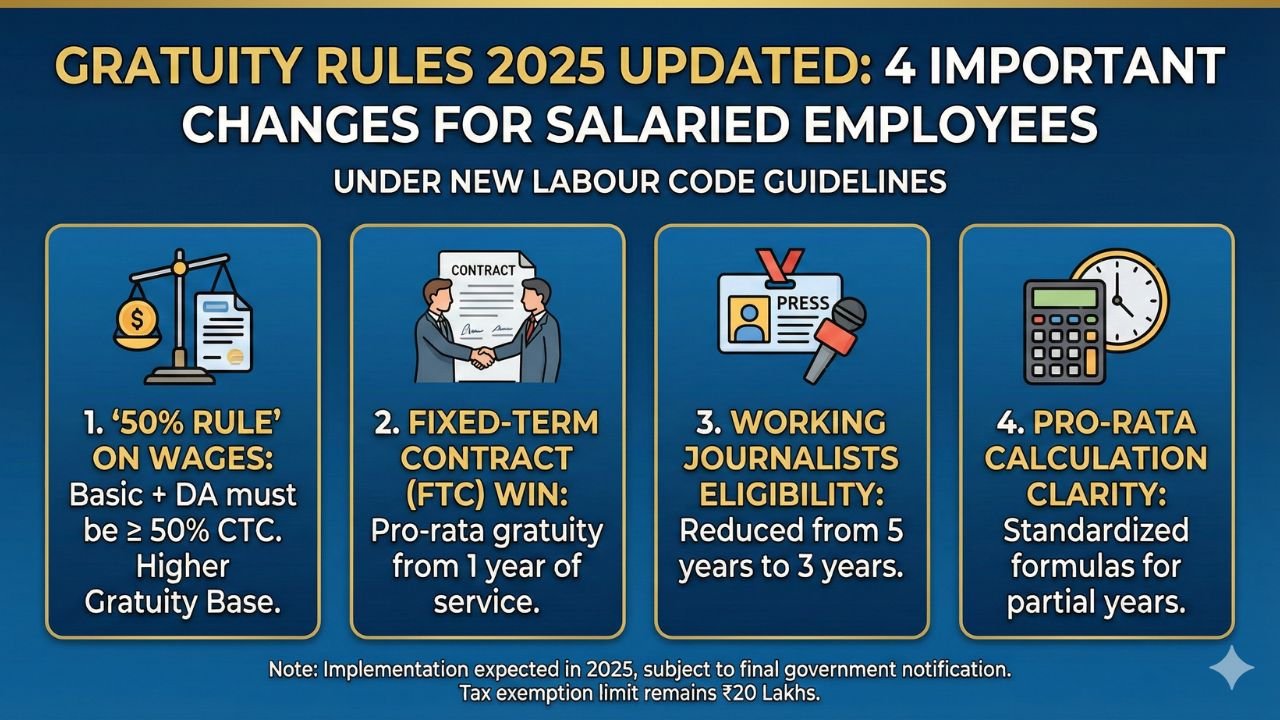

Infographic: Standard vs. Zero Depreciation Car Insurance

| Feature | Standard Insurance | Zero Depreciation Insurance |

|---|---|---|

| Payout for repairs | Deducts depreciation value of parts | Pays full repair cost (minus standard deductible) |

| Owner’s out-of-pocket | High (depreciation + mandatory deductible) | Very Low (just standard deductible) |

| Eligibility at delivery | Always | Recommended for new vehicles |

| Parts covered | Reduces for plastics, rubber, etc. | 100% for all parts except some consumables |

| Claim process | Lengthy verification, more disputes | Quick, cashless, hassle-free |

Frequently Asked Questions

Is my new car insured before I leave the showroom?

Yes, dealerships are bound to activate insurance before delivering the car, with the policy paid by the buyer. Coverage starts immediately.

Will insurance cover all repair costs if my car crashes during delivery?

If you have zero depreciation insurance (common for new cars), nearly all repair costs will be covered, except nominal charges. For standard insurance, depreciation is deducted.

What about damage to showroom property?

Damage to showroom premises is generally not covered by standard car insurance. The showroom may seek a direct settlement or claim under their own property insurance.

Do I need to pay out of pocket?

With zero-dep, you pay only standard deductibles (often around ₹1000–₹2000). Without zero-dep, you may pay much more, especially for plastics and glass repairs.

How quickly can claims be settled?

Most reputable insurers and cashless service centres settle claims within days, especially when documentation is complete and zero-dep is included.

Join Our Community for More Insights

👉 Join Our Telegram Channel for Daily Market & Insurance UpdatesFor more in-depth tips on sharing accident-proofing, insurance guides, and trading insights, bookmark this page and join our growing Telegram community.

Post Comment